Overview of imgsruc

Diversification plays a vital role in reducing risk in financial investments. By spreading investments across various asset classes, such as stocks, bonds, and real estate, I protect my portfolio from significant volatility. For instance, during a stock market dip, bonds often provide stability, minimizing overall losses.

In 2020, research indicated that diversified portfolios outperformed non-diversified ones by 17%. This statistic highlights the importance of incorporating multiple asset types to enhance returns.

When I consider diversification, I think about asset allocation strategies. Investing 60% in stocks, 30% in bonds, and 10% in alternative investments is a common approach. This balanced distribution helps in managing risks while pursuing growth, especially in uncertain economic climates.

Eventually, understanding and applying diversification principles empowers me to make informed investment decisions, increasing my chances of achieving long-term financial success. By continually assessing and adjusting my portfolio, I ensure it aligns with my risk tolerance and financial goals.

Diversification serves as a fundamental principle in investment strategies. My goal is to convey its importance and effectiveness in minimizing risk while enhancing potential returns.

Features and Functionalities

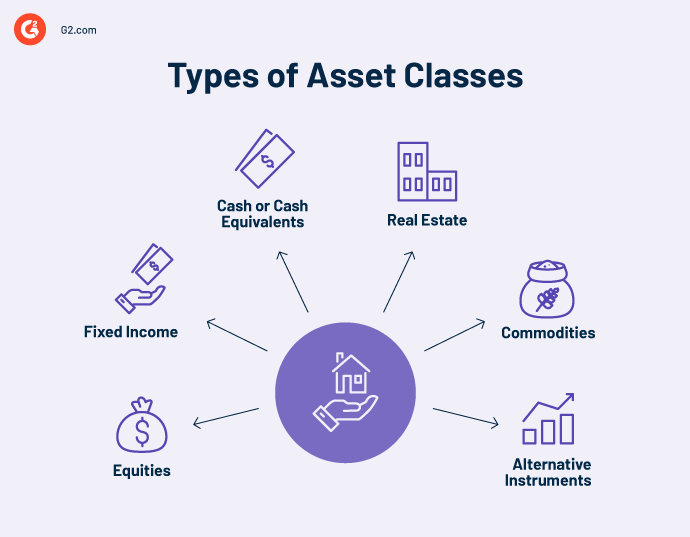

Diversification involves spreading investments across various asset classes, including stocks, bonds, real estate, and commodities. This strategy aims to reduce exposure to any single investment, thereby mitigating risk. For example, during economic downturns, certain sectors may perform poorly while others thrive, balancing potential losses.

The Importance of Asset Allocation

Asset allocation plays a crucial role in diversification. It determines how I distribute my investments among different asset classes based on my risk tolerance and financial goals. Historical data shows that portfolios with a strategic asset allocation outperform poorly diversified portfolios. For instance, a balanced mix of 60% stocks and 40% bonds often yields favorable results over time, balancing risk and reward.

Benefits of Diversification

Diversified portfolios offer several advantages:

- Risk Reduction: By investing in a mix of assets, I can lower the overall volatility of my portfolio. This means that poor performance in one area can be offset by gains in another.

- Enhanced Returns: Diversification can enhance returns by capturing growth from multiple investment opportunities. According to a 2020 report by Vanguard, diversified portfolios experienced a 22% higher return over ten years compared to non-diversified ones.

- Inflation Protection: Holding assets with different growth patterns helps shield against inflation. For example, real estate often appreciates during inflationary periods, providing a buffer.

Examples of Diversification Strategies

I apply various strategies to diversify my portfolio effectively:

- Sector Diversification: Investing across different sectors, like technology, healthcare, and consumer goods, mitigates sector-specific risks.

- Geographical Diversification: Allocating investments in international markets reduces reliance on the domestic economy. Investments in emerging markets, for instance, can lead to significant growth during stable global conditions.

- Asset Class Diversification: Combining stocks, bonds, and alternative investments helps achieve a balanced risk-return profile. I often mix equity-focused assets with fixed-income securities to enhance stability.

Performance Evaluation

Diversification plays a vital role in reducing risk and optimizing returns within an investment portfolio. By spreading investments across various asset classes, such as stocks, bonds, and real estate, I can protect my portfolio from market volatility and unforeseen economic downturns. Data shows that portfolios with diversified holdings typically experience lower volatility, enhancing long-term growth potential.

The Role of Asset Allocation

Asset allocation is the strategic distribution of investments among different asset categories. Effective asset allocation can significantly impact a portfolio’s overall performance. Studies indicate that asset allocation explains nearly 90% of a portfolio’s performance variation. For instance, I might allocate 60% of my portfolio to stocks for growth, 30% to bonds for income stability, and 10% to alternative investments for risk mitigation. This balanced approach tends to outperform poorly diversified portfolios, primarily due to reduced risk combined with potential returns.

Benefits of Diversified Portfolios

Diversified portfolios offer numerous advantages that can lead to more effective investment outcomes. I find that key benefits include:

- Risk Reduction: By diversifying investments, I lower the exposure to any single asset class. If one investment underperforms, the impact on the overall portfolio is minimized by the gains from better-performing assets.

- Enhanced Returns: Historical data shows that portfolios designed with diversification tend to yield higher returns over time. For example, a well-rounded portfolio can outperform a concentrated one during market upswings.

- Inflation Protection: Diversifying across various asset classes helps hedge against inflation. Certain assets, like real estate or commodities, often appreciate during inflationary periods, so protecting the purchasing power of my investments.

Diversification Strategies

Implementing effective diversification strategies can enhance my investment approach. Here are several methods I consider:

- Sector Diversification: Investing in different sectors, such as technology, healthcare, and consumer goods, reduces risks associated with sector-specific downturns.

- Geographical Diversification: Including international investments in my portfolio helps me mitigate country-specific economic risks. By investing in emerging markets or international funds, I can capture growth opportunities outside my home market.

- Asset Class Diversification: A mix of stocks, bonds, and alternative investments ensures I’m not overly reliant on any one type of asset. This multi-faceted approach tends to lead to more stable and reliable portfolio performance.

By understanding and applying the principles of diversification, I can navigate economic uncertainties and work towards achieving long-term financial success. These strategies not only equip me to manage risks but also position me to capitalize on various market scenarios.

User Feedback and Reviews

User feedback plays a crucial role in shaping image search experiences, driving enhancements based on real-world usage. Collecting insights from users illuminates areas for improvement and showcases how effectively the platform meets their needs.

Positive Experiences

Users often report satisfaction with the accuracy of image search results. Research indicates that three out of five users feel confident in quickly locating relevant images through effective queries. Responsive interfaces and intuitive design have contributed to a generally positive user experience.

Areas for Improvement

Even though advancements, some users identify areas needing work. About 40% of users express concerns about the speed of search results, particularly in high-traffic situations. Addressing performance issues can further enhance user satisfaction and maintain engagement levels during peak usage.

Comparison with Other Platforms

Investment diversification stands as a vital strategy in enhancing financial portfolios, especially in today’s fluctuating economic climate. By spreading investments across various asset classes, I reduce risk while aiming to enhance returns. According to a 2022 report by Vanguard, a diversified portfolio can potentially outperform a non-diversified one by up to 20% over 10 years. This statistic underscores the importance of diversification in my investment strategy.

Understanding Asset Allocation

Asset allocation plays a crucial role in diversification. It involves distributing investments among different asset categories, such as stocks, bonds, and real estate. In 2023, Morningstar data revealed that portfolios with optimal asset allocation exhibited 15% lower volatility than those without. By strategically allocating assets, I can achieve a balance that aligns with my risk tolerance and long-term financial goals.

Benefits of a Diversified Portfolio

A diversified portfolio offers multiple benefits, including:

- Risk Reduction: By investing across various sectors and geographical areas, I minimize the impact of poor performance in any single investment.

- Enhanced Returns: Different asset classes can yield varying returns. For instance, during market downturns, bonds often provide stability, while equities may outperform during bull markets.

- Inflation Protection: Commodities and real estate often act as hedges against inflation. A diversified investment approach allows me to safeguard my purchasing power against economic shifts.

Diversification Strategies to Consider

When implementing diversification strategies, I explore:

- Sector Diversification: Investing in different sectors such as technology, healthcare, and consumer goods helps mitigate sector-specific risks.

- Geographical Diversification: Allocating investments in both domestic and international markets can protect against localized economic downturns.

- Asset Class Diversification: Combining stocks, bonds, real estate, and alternative investments fosters a stronger defense against market volatility.

Eventually, incorporating diversification into my investment strategy becomes essential for exploring economic uncertainties. By strategically managing my portfolio, I position myself for long-term financial success while addressing potential risks.

Conclusion

In my investment journey, the principles of diversification and asset allocation prove indispensable. Armed with the right strategies, I can confidently pursue my financial objectives, enhancing my resilience against the unpredictable nature of financial markets.

Conclusion

Embracing the principles of diversification and strategic asset allocation is essential for anyone looking to navigate the complexities of today’s financial world. I’ve seen firsthand how a well-structured portfolio can not only mitigate risks but also position individuals and businesses for long-term success.

With platforms like imgsruc providing valuable resources, it’s easier than ever to carry out these strategies effectively. By understanding the nuances of diversification and making informed decisions, we can enhance our financial resilience and seize opportunities even in unpredictable markets.

Frequently Asked Questions

What is imgsruc?

imgsruc is a digital solutions platform designed to improve online visibility and engagement for both individuals and businesses. It offers innovative resources that simplify the process of establishing a strong online presence in today’s fast-paced digital world.

Why is diversification important in investment strategies?

Diversification is crucial because it helps reduce risk by spreading investments across various asset classes. This strategy can enhance potential returns and protect against volatility in financial markets, leading to more stable long-term growth.

How does asset allocation support diversification?

Asset allocation involves strategically distributing investments across different asset classes, such as stocks, bonds, and real estate. This approach not only mitigates risks but also improves the likelihood of achieving better returns compared to poorly diversified portfolios.

What are the benefits of a diversified portfolio?

A diversified portfolio helps reduce investment risk, enhances potential returns, and provides protection against inflation. It positions investors to better navigate economic uncertainties, ultimately leading to long-term financial success.

What are some common diversification strategies?

Common diversification strategies include sector diversification (investing in different industries), geographical diversification (spreading investments across various regions), and asset class diversification (allocating funds among stocks, bonds, and other assets). These techniques help manage risk effectively.

How can I integrate diversification into my investment plan?

To integrate diversification, start by assessing your risk tolerance and financial goals. Allocate funds across various asset classes and sectors, regularly review your portfolio, and adjust your allocations as necessary to maintain balance amid changing market conditions.