Overview of DC9Funds

DC9Funds refers to the benefit funds managed by District Council 9 (DC9) of the International Union of Painters and Allied Trades (IUPAT). These funds support members of Local Unions 18, 19, and 20 in New York.

What Is DC9Funds?

DC9Funds is a management system for benefit funds available to District Council 9 members. The platform allows easy access for members to view their benefits, promoting transparency and accessibility.

- Login and Access: Members use their registered email as a username to log in and access their benefit information securely.

- Transparency in Coverage Compliance: The platform adheres to the No Surprises Act Transparency Notice, ensuring that members receive clear and comprehensive benefits information.

- Registration and Password Management: Members can easily register for an account and have the option to reset their passwords for security, enabling seamless management of their accounts.

Investment Strategies

Investment strategies are tailored to meet varying individual goals, risk tolerances, and unique financial situations. I recognize that these strategies differ greatly and require continuous evaluation and adjustment as circumstances change.

Types of Investments Offered

I explore three primary categories of investments available:

- Stocks: These represent ownership in companies and typically carry higher risk with the potential for substantial returns. For instance, the S&P 500 has historically averaged annual returns of around 10-11%.

- Bonds: Often perceived as safer investments, bonds generally provide lower returns than stocks. For example, U.S. Treasury bonds are known for their stability, offering a fixed interest rate over time.

- Real Estate: This includes residential and commercial properties, which I find can vary in risk depending on market conditions. Historically, real estate has appreciated in value by about 3-4% annually, providing a blend of safety and growth potential.

Risk Management Approaches

I emphasize the significance of robust risk management approaches in investment strategies. These can include:

- Diversification: Spreading investments across various asset types reduces overall risk. For instance, a balanced portfolio might combine stocks, bonds, and real estate.

- Hedging: Utilizing financial instruments to offset potential losses. I might buy put options on stocks to protect against sharp declines.

- Regular Portfolio Review: Continually assessing and realigning investments based on market changes and personal financial goals ensures I maintain an optimal risk-reward balance.

Investing often feels daunting, especially if you’re new to the financial world. I remember my initial steps into investments—confusing terms and overwhelming choices. But, grasping the basics can significantly simplify the journey and boost your confidence. Here, I’ll break down key concepts and provide useful statistics to help you get started with investing.

User Experience

Investing involves allocating resources, usually money, to generate a profit or income. Unlike saving, which keeps money in a bank for future use, investing aims for growth over time. According to a study by the Securities and Exchange Commission (SEC), investors who engage in long-term strategies tend to see more significant returns, averaging around 7% to 10% annually after inflation.

Types of Investments

Investors can choose from various investment types based on their risk tolerance and financial goals. Here are the main categories to consider:

- Stocks: Owning shares of a company offers growth potential but comes with higher volatility. Stocks have historically returned about 10% annually on average.

- Bonds: These are loans made to governments or corporations. They typically offer lower returns, averaging 5% to 7%, and are considered safer than stocks.

- Real Estate: Investing in property can yield rental income and appreciation. According to the National Association of Realtors, real estate has delivered about 8% annual returns historically.

The Importance of Diversification

I understand the fear of putting all eggs in one basket. Diversification mitigates risk by spreading investments across different assets. A diversified portfolio can withstand market fluctuations better than a concentrated one.

Example of Diversification:

Suppose I invest in stocks, bonds, and real estate. If stock prices drop, my bonds may rise, balancing overall performance. The goal is to create a portfolio that meets my risk tolerance and investment horizon.

Understanding Risk Tolerance

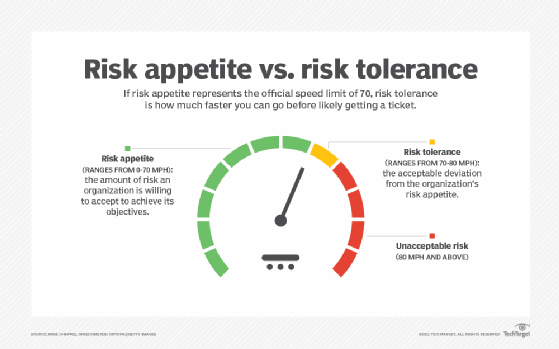

Risk tolerance measures how much risk an investor is willing to take. Factors influencing my risk tolerance include age, financial goals, and investment experience. Younger investors often have higher risk tolerance because they have time to recover from losses.

- Conservative: Prioritizes capital preservation, favors bonds and stable investments.

- Moderate: Balances between stocks and bonds to achieve moderately high returns.

- Aggressive: Seeks high returns, primarily through stocks, accepting higher risks.

Getting Started with Investing

To begin on my investment journey, I can follow these straightforward steps:

- Set Financial Goals: I determine short- and long-term goals to guide my investment choices.

- Educate Myself: Learning through books, webinars, or financial advisors helps build my knowledge.

- Choose an Investment Account: Selecting the right account, like an IRA or brokerage account, aligns with my objectives.

- Start Small: Investing smaller amounts initially can help ease into the market.

Investing may appear complex, but understanding these core concepts is essential. By starting with clear goals, diversifying my portfolio, and grasping my risk tolerance, I can build a solid foundation for my financial future. As I proceed, continuous learning and adapting my strategy will keep my investments aligned with personal and market changes.

Performance Analysis

The performance analysis of dc9funds highlights the importance of understanding the fund’s purpose and management. Although specific performance metrics aren’t publicly available, the funds aim to provide essential benefits to members of the District Council 9 New York IUPAT.

Historical Returns

Historical returns for dc9funds remain undisclosed. The internal management by District Council 9 New York IUPAT keeps this information confidential, limiting access for prospective members and stakeholders.

Comparison with Competitors

Dc9funds represents a distinct offering specific to District Council 9 New York IUPAT, making direct comparisons with competitors impractical. Other investment funds may focus on different sectors or investment strategies, underscoring the unique nature of dc9funds.

Investing can seem overwhelming, but breaking it down into manageable concepts helps build confidence. With the right approach, understanding investment strategies becomes accessible and enriching. In this text, I’ll explore key strategies and important factors to consider when beginning your investment journey.

Security Measures

I always emphasize the necessity of setting clear financial goals before diving into investments. Whether it’s saving for retirement, funding education, or purchasing a home, specific objectives can shape your investment strategy. According to a study by Fidelity Investments, 89% of investors with defined goals report feeling more positive about their financial futures.

Understanding Risk Tolerance

Recognizing my risk tolerance plays a significant role in choosing the right investment strategy. Risk tolerance is the degree of variability in investment returns that I’m willing to withstand. Generally, younger investors might lean toward riskier assets like stocks for long-term growth, while those nearing retirement tend to prioritize stability through bonds or cash equivalents. According to the SEC, balancing higher and lower-risk investments can mitigate potential losses while capitalizing on growth opportunities.

Diversification: A Key to Stability

Diversification is another essential concept I always consider. By spreading investments across various asset classes—such as stocks, bonds, and real estate—I decrease the impact of a poor-performing investment on my overall portfolio. The principle of diversification relies on the idea that not all asset classes move in tandem; historically, this strategy has led to more stable returns over time.

Different Types of Investments

Understanding the types of investment options available is crucial. Here’s a breakdown:

- Stocks: Equity investments providing part ownership in a company. They offer high growth potential but may come with higher volatility.

- Bonds: Debt securities that typically offer more stability, allowing me to earn interest over time, with relatively lower risk compared to stocks.

- Real Estate: Property investments that generate income and appreciation. Real estate tends to be less volatile than stocks and provides a hedge against inflation.

The Multifaceted World of Investment Accounts

Choosing the right investment account matters for effective financial planning. Options range from tax-advantaged accounts like IRAs and 401(k)s to taxable brokerage accounts. Utilizing tax-efficient strategies reduces my tax burden on investment gains, enhancing overall returns.

The Role of Education in Investing

Continuous education plays a vital part in becoming a successful investor. Resources like financial news, books, and courses provide insights into market trends and investment strategies. According to a 2020 survey by Charles Schwab, 70% of newly-invested individuals reported that knowledge boosts their confidence in making investment decisions.

Conclusion

Investing intelligently hinges on setting clear goals, understanding risk tolerance, diversifying investments, selecting suitable investment accounts, and prioritizing education. By following these fundamental principles, I can navigate the investment world more effectively and build a solid financial foundation. Whether aiming for short-term gains or long-term wealth accumulation, each decision plays an integral role in overall investment success.

Conclusion

DC9Funds stands out as a valuable resource for investors looking to navigate the complexities of the financial world. Its commitment to transparency and tailored strategies empowers individuals to make informed decisions. By focusing on fundamental principles like risk tolerance and diversification, I believe anyone can build a solid financial foundation.

Whether you’re just starting or looking to refine your approach, embracing education and setting clear goals will pave the way for successful investing. With platforms like DC9Funds, the journey toward financial growth becomes more accessible and manageable.

Frequently Asked Questions

What is DC9Funds?

DC9Funds is a platform that combines technology and finance to simplify the investment process for various investors, especially benefit funds managed by District Council 9 in New York. It focuses on transparency, secure access, and personalized investment strategies.

What types of investments does DC9Funds offer?

DC9Funds offers a variety of investment options, including stocks, bonds, and real estate. This diversity allows investors to build a balanced portfolio and engage in various markets.

Why is diversification important in investing?

Diversification helps manage risk by spreading investments across different assets. This approach can protect your portfolio from significant losses when one investment underperforms, leading to a more stable overall return.

How can a beginner set financial goals?

Beginners can set financial goals by assessing their current financial situation, identifying short-term and long-term objectives, and creating a plan that aligns with their aspirations. Clear, realistic goals provide direction and motivation for investing.

What is risk tolerance in investing?

Risk tolerance refers to an investor’s ability and willingness to withstand losses in their investment portfolio. It varies from person to person and is influenced by factors like financial situation, investment experience, and personal comfort with volatility.

How should beginners choose an investment account?

Beginners should consider their investment goals, the types of assets they want to invest in, and any fees associated with accounts. Options include brokerage accounts, retirement accounts (like IRAs), and robo-advisors, each catering to different needs.

Why is education important in investing?

Education is crucial in investing because it empowers individuals to make informed decisions, understand market trends, and develop effective strategies. Knowledge helps investors navigate risks and increases the chances of achieving financial success.